Financial markets like forex, stock, etc, are volatile and have constant price fluctuations. That is when technical analysis tools like candlestick charts are required to perform secure trading. These equipment examine the fee highs and lows, which maintains the buyers updated in the marketplace developments and helps them make informed decisions.

An inverted hammer candlestick is a sort of candlestick pattern that suggests price fluctuations inside the marketplace. Use this article as your guide to apprehend marketplace fluctuations better and discover ways to read inverted hammer candlestick charts.

What is an Inverted Hammer Candlestick?

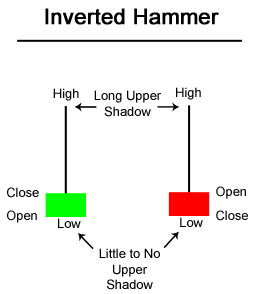

It is a kind of a technical analysis tool common like an upside-down hammer, indicating a style reversal within the market. The form is formed while the marketplace fee hits a high and significantly falls near the opening price. The sample may be seen in two shades, pink and green; right here is what every color indicates:

Red Inverted Hammer Candlestick

The red hammer candlestick suggests that the last rate is lower than the hole rate. When the sample is fashioned on the analysis chart, look forward to the subsequent hammer signal. If the pink sign manner the fee will fall further down, indicating that traders need to now not exchange on that inventory or currency. Sensibull broker provides a top notch platform to use candlestick analysis charts and a wide range of shares or property for buyers to buy or sell.

Green Inverted Hammer Candlestick

Contrary to the crimson, the inexperienced inverted hammer suggests that the final rate is higher than the opening charge. When the candlestick sample emerges as green, the fee will circulate better.

Inverted Hammer Candlestick Patterns

The inverted hammer candlestick styles are clean to discover due to the fact it’s miles divided into three elements:

- Small body: The candle pattern has a small frame, which means the final and opening costs are close.

- Upper wick or shadow: The inverted hammer candlestick pattern should have a long upper wick, indicating a drastic drop in the stock price. A wick is a long vertical line that extends over the body.

- Lower wick or shadow: The pattern should have little or non-existent lower wick or shadow. To understand the patterns better, benefit from educational resources on market analysis or technical analysis tools in trading provided by Vault Markets broker.

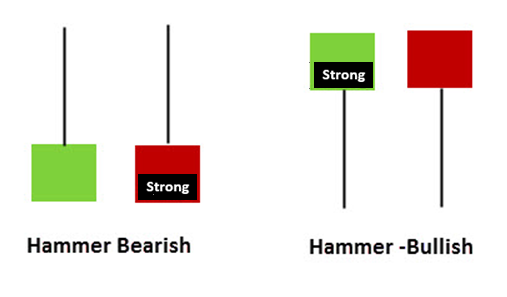

Bullish and Bearish Inverted Hammer Candlestick

A bullish pattern indicates that the market is going up. This is called bullish reversal, and inverted hammer candlestick also refers to it the inverted hammer candlestick represents a falling market.

Bullish reversal, more specifically referred to as the bearish sample, represents the marketplace downtrend with an inverted hammer sample. A bullish pattern is an upward hammer sign, also known as the inverted hammer taking photographs movie star candlestick.

In the Bullish pattern, the candle’s body is on top, followed by a long wick or shadow; the bearish pattern is vice versa. Check out the image below for a better understanding:

bearish and bullish hammer in Inverted hammer candlestick

How to Read Inverted Hammer Pattern?

Reading the inverted hammer pattern is possible with a complete understanding of the pattern and how it works. Follow the below steps to read the patterns correctly:

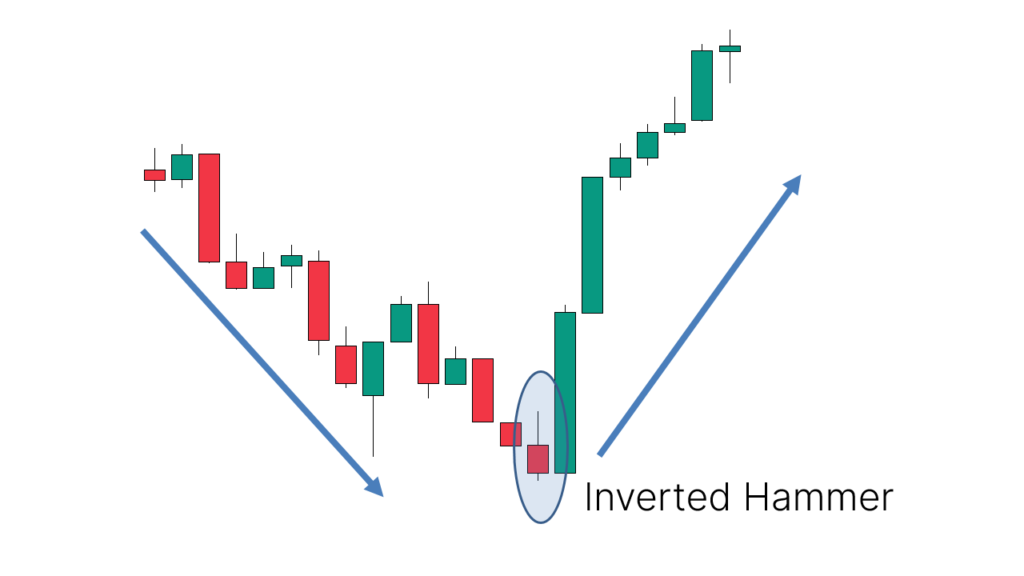

Spot the patterns: The first step of using the technical analysis tool is to spot the candlestick patterns forming on the charts.

Confirm the patterns: Once you spot a candlestick pattern, confirm by matching it with the ideal stock candlestick pattern. It should have a small body, a long wick or shadow on top and a small wick or shadow at the bottom of the body. The pattern should represent the sudden drop from bullish to bearish.

- Trade Volume: Keeping tune of the trading volume is crucial as it determines the buying call for for the inventory, which means that the higher the quantity, the better the stock’s buying fee.

- Risk Management: Finding suitable threat management strategies to manipulate the dangers associated with inventory buying and selling. In the inverted hammer candlestick chart, investors can upload a prevent order on the give up of the candle frame to reduce or minimise dangers. Learn helpful danger control strategies thru the sources provided through Botbro broker.

- Price Action: Keep a close eye on the price movements and look for bullish candlestick signs to ensure more people buy the particular asset or stock.

Benefits of Using Inverted Hammer Candlestick Charts

- Easy to Identify: The pattern has a very identical figure with a small body and a long upper wick, which makes it easier for traders to locate it in the charts.

- Entry and Exit points: It acts as a great market indicator for deciding entry and exit points in the trading market.

- User-friendly: To analyse a candlestick chart, traders do not require any difficult calculations or application of formulas. All you have to do is hold an eye fixed at the chart and tune the candlestick styles, making it easier for newbie buyers to use this technical evaluation tool.

- Reverse Indicator: The candlestick charts let you examine whilst the marketplace is headed for a bullish reversal, meaning a marketplace in a downtrend is changing right into a marketplace uptrend. This indicator can help buyers to shop for the inventory and reduce promoting stress.

- Market Behaviour: The change in market behaviour from bearish to bullish is indicated through the candlestick analysis chart, ensuring that the traders know the market movement.

Limitations of Inverted Hammer Candlestick Charts

- Fake Signals: The candlestick pattern can show up by mistake and send false signals, potentially misleading the traders. So, this analysis tool can only be trusted with a grain of salt because traders can lose their money if the signal is false.

- Various Factors: The hammer candlestick chart is unreliable to a certain extent because it relies on multiple external factors like timeframe, market trend and market conditions. Use tools like economic calendar and other market analysis tools to get a second opinion on the market situation before starting trading..

Read also: Vested vs. INDmoney

- Not a Fixed Indicator: This market analysis tool is subjective, which creates multiple interpretations and opinions. Therefore, the usage of this tool varies from person to person and does not have a fixed conclusion.

Conclusion

Overall, the inverted hammer candlestick chart is a remarkable technical analysis tool for stock and CFD trading as it is easy to read and recognisable on the chart. Moreover, it does not require traders to do complicated math problems, it only requires careful observation of the market and appearance of the candlestick pattern.

Therefore, this analysis tool is suitable for novice and experienced traders but comes with risks. The patterns can not be wholly relied upon because they can be false and mislead traders into making wrong decisions in a rush. We would recommend you to use multiple analytical tools to ensure your price prediction before buying or selling an asset, stock, etc.

FAQs

What is a Bullish Reversal?

The bullish reversal way the start of an uptrend market following a downtrend, additionally called an inverted hammer candlestick. Bullish reversal shows that the market prefers shopping for instead of selling the inventory.

How to change Inverted Hammer Candlestick?

By carefully gazing the chart, you could change shares and CFDs thru invested hammer candlestick evaluation. Once the candlestick styles display up, search for signs and symptoms that are expecting a reversal of the chart from bearish to bullish, and also you should change best if a reversal is feasible.

What does an Inverted Hammer Candlestick imply?

It is a technical analysis tool utilized in inventory and CFD trading to calculate stock costs, price highs and lows and pick out access and exit factors within the market.

What does a Red Inverted Hammer Candlestick imply?

An inverted pink hammer candlestick pattern means the marketplace charge is lower than the outlet fee.