For every new investor searching for a profitable stock investment, the most common question remains – What is the Negative P/E ratio & how does it affect your investment decision? If you’re also in the same situation, this article will help you to a great extent.

There are some fundamentals of investing, like the PE ratio, that you should know before getting started with your investment. You can use a variety of ratios to gauge the performance of your stock market investments.

The price-to-earnings (PE) ratio is an example of such fundamentals. Here, we will provide complete information on the PE ratio and its impacts, specifically the negative PE ratio. Let’s get started.

What is A Negative P/E Ratio?

For investors asking – What is a negative PE ratio meaning? Here’s a simple definition. The negative PE ratio refers to a company’s negative earnings or losses. When PE is negative, though, everything changes completely. For example, a stock shows negative earnings if the PE ratio is negative. It can also help to determine the future earnings growth of the company’s stock by following structured financial planning.

Generally, a high PE ratio denotes an expensive stock, whereas a low PE ratio denotes a cheap stock value. You can always use both a negative P/E ratio and a positive PE ratio to determine a company’s current and past performance.

Calculation of PE Ratio

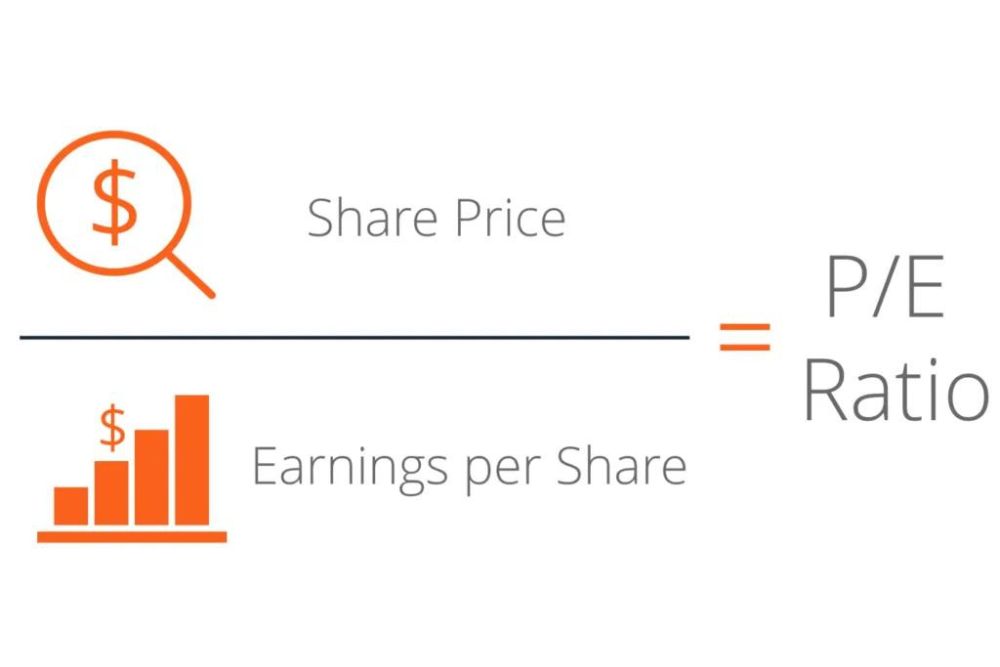

The PE ratio can be calculated as P/E = Particular Stock Price / Earnings Per Share.

The PE ratio can be calculated as:

P/E = Stock’s Price / Earnings Per Share.

The resulting number indicates how much investors are willing to pay for each rupee of share earnings. The lower the PE ratio, the better for investors.

If a company’s annual earnings per share (EPS) are less than zero or it is going into negative territory, it shows a negative P/E ratio. However, earnings per share might vary depending on the accounting system used in the entire industry.

Thus, a negative P/E ratio isn’t always a sign that a company is a poor investment or a company’s share price is declining. It is also affected by many other factors.

What Does A Negative Price To Earnings (PE) Ratio Mean?

Let’s understand the negative PE ratio in simple terms with an example: Suppose a company has a low PE ratio. It has been suffering losses; thus, this indicates a negative PE ratio. You could think investing in such a company with a negative P/E ratio is a bad idea. However, this is not always the case.

It can be very risky if the PE ratio has been consistently declining over several years. However, you must also consider other metrics like market trends, market price and rivalry another negative P/E ratio. Moreover, the market share price can never be negative, so the only mathematical possible way the P/E ratio can be negative is a negative EPS number.

A negative EPS indicates that the stock’s trailing 12-month net income was negative. In other words, the total profits for the previous four fiscal quarters are negative. The sum below zero does not imply that every quarter was negative. Hopefully, you might now have understood that a negative P/E ratio cannot imply that the stock is a bad investment.

The business may be having trouble, routinely spending more money than it brings in to stay in the competition. As a result, this company is probably a lousy investment and is likely to go bankrupt.

Many businesses with rapid revenue growth, such as some tech stocks, are loss-making. But because they are expanding quickly and could eventually turn a profit, investors prefer to invest in them.

Even though a corporation didn’t lose money, adjustments to accounting practices occasionally lead EPS to drop for a while. For example, a business could have to make a significant one-time payment all at once, such as a large fine. Due to this, EPS and PE may momentarily turn negative.

What is Trailing PE Ratio?

Other than the P/E Negative Ratio, there is another term, ‘Trailing PE ratio’. Instead of using forecasts for the future, trailing PE ratios are calculated using a stock’s earnings per share for the previous 12 months. Conscious investors don’t necessarily believe analyst projections or publicly available data from a company.

This valuation method is popular among investors as it is more objective and relies on actual data rather than projections. Meanwhile, this approach also has certain shortcomings.

In other words, prior earnings are not always indicative of future ones. Moreover, the price of a stock yesterday may not always be a reliable indicator of the price tomorrow due to frequent fluctuations in the stock market.

What is Forward PE Ratio?

A PE ratio generated from anticipated future earnings is referred to as a forward PE ratio other than a negative PE ratio. It is frequently referred to as an estimated PE ratio because it is an estimate. In addition, businesses often show their own prospective PE ratio.

When comparing present earnings to projected future earnings, forward PE ratios can help estimate growth. Additionally, if the estimates are true, they might provide investors with information about stocks that are anticipated to enjoy growth in the near future.

Effects of Negative P/E Ratio:

Investors are frequently alarmed by a negative PE ratio. It can signify that the organization is struggling and might file for bankruptcy soon.

However, it must be understood that a persistently negative P/E Ratio across the company’s balance sheet is frequently a source of worry for investors.

On the other hand, it’s not always terrible if the negative PE Ratio is transient and happens as a one-time incidence. A negative P/E Ratio is not always a bad thing for the following reasons:

A one-time event, such as an unanticipated loss or litigation that results in a negative P/E Ratio, will only affect that year’s earnings. In this situation, it is preferable to understand that negative P/E Ratios for that specific year may only apply to that specific year. Due to this, investors may find it useful to take trailing PE Ratios into account in order to gain a better understanding of the company.

Negative PE Ratios that result from the investment in various resources and initiatives could indicate that the company will see higher growth possibilities in the future than are currently anticipated. Therefore, negative P/E Ratios might not be a reliable indicator of the company’s earnings.

What If The PE Ratio Is Negative?

If a stock has a negative PE ratio, you could be debating whether it is worthwhile to invest in it. But, first, you should determine whether the company has experienced losses because of a negative PE ratio in the past or more recently by comparing current earnings.

Losses that keep coming in can indicate difficulties for a particular company. It’s also beneficial to compare the profits of competing businesses in the same sector. If the majority of the businesses in the same industry are losing money, then perhaps the entire sector is going through a brief cyclical slump.

Examining the cash flow statement is an excellent technique to determine whether accounting is liable for negative earnings or negative P/E. The chances of better results are high compared to other methods.

This might reveal if the business is genuinely losing money or whether any accounting regulations are to blame for the negative results. You can compare it to a single company with similar companies to make an informed investment decision.

You can do this using the negative P/E ratio of one company and the other. It’s also good to look at a company’s sales growth rate and margin trends. You can take the help of various financial sites. Some high-growth businesses invest all their profits in expanding their operations, but they still have a direct route to profitability if their plans pan out.

Nevertheless, investing in biotech stocks and unsuccessful growth enterprises might be dangerous. If you don’t know what you’re doing, avoid investing in stocks based on such industries. These stocks often have little to no revenue and high expenses.

A stock’s low PE ratio does not always indicate poor investing potential. The PE ratio is one figure among many; therefore, it must be seen in the context of other measures and the company’s potential for growth.

Because the meaning of a large and small figure is reversed, a negative P/E ratio is particularly perplexing. To put it another way, a substantially negative number is preferable to one that is only slightly negative.

The opposite of a positive PE ratio is that a lower number is typically viewed as advantageous, and a higher number suggests that the stock is more expensive.

Is The Negative price to earnings (PE) ratio a bad sign for investors?

Is a negative P/E ratio good? A P/E ratio with a steady or steady increase is a good one with a good earnings yield. But, of course, the earnings yield could differ depending on the specific company, which means that it is not always bad for investors.

If P/E ratios are analyzed without considering a company’s recent performance, they may be deceptive. In general, it is better to invest in a firm whose P/E ratio appears to appropriately reflect the stock’s value rather than taking a financial risk on a stock that appears to be over or overvalued.

The justified price-to-earnings ratio is computed separately from the benchmark P/E. In other words, the two ratios ought to yield two distinct outcomes.

Limitations Of PE Ratio

The major drawback of the P/E ratio is its difficulty in comparing businesses across industries. Additionally, the P/E ratios of various businesses might vary greatly. It also depends on the current earnings. You need to keep a complete picture in mind, especially in the case of a negative P/E ratio.

Current-year profits alone cannot be used to determine a stock’s true value. Instead, all anticipated future cash flows and earnings of a corporation determine the value. A decent place to start is with the price-to-earnings ratio. Without knowledge of the company’s risk profile and EPS growth potential, it is meaningless on its own.

To acquire a more accurate view of a firm’s value and performance, an investor of such companies needs to delve further into the company’s financial statements and employ additional methods of financial research and valuation.

The Price Earnings Ratio might also yield erroneous findings. For example, a decrease in earnings will result in negative EPS and a negative P/E. Conversely, a corporation with very no net income might have an extremely high P/E, translating into a very low EPS in decimals.

Bottom Line

Now, you understand – What is Negative P/E Ratio and how a negative PE ratio can impact your investments. The current stock price-to-earnings ratio (P/E) is a crucial gauge of a company’s market value on the stock exchange. For evaluating a company’s health, the PE ratio is helpful. To comprehensively understand the share’s potential, combine it with other analytical tools.

And remember that a negative PE ratio is not always a bad sign for investors. It is not a good idea to base your assessment of the financial health of any company solely on one ratio.

Other criteria must be taken into account as well in order to get the full picture of a possible investment. For example, while the Price-Earnings Ratio can be a reliable value indicator when viewed alone, it has the potential to deceive or misinform.

So, now that you have understood – What is a Negative P/E Ratio? It’s time to put all your theoretical knowledge into action. Start investing in stocks by opening a trading account with InvestFW. The brokerage platform offers a range of financial instruments for trading.

FAQs

What Does a Negative PE Ratio Mean?

A stock has negative earnings if the PE ratio is negative. It can also help to determine the future earnings growth of the company’s stock by following structured financial planning.

What Does A Negative PE Ratio Mean For Stock?

A negative PE ratio for stock means the company is subjected to negative earnings. For stock investors, it may or may not be a bad investment.

What is Negative PE Ratio?

The negative PE ratio refers to the negative earnings of a company or losses of the company. When PE is negative, though, everything alters completely.

What is A Negative PE Ratio Mean For Investors?

A negative PE ratio is not always bad for investors. A P/E ratio that is steady or exhibits a steady increase is a good one with a good earnings yield. But, of course, the earnings yield could differ depending on the specific company, which means that it is not always bad for investors.

Is Negative PE Ratio Good Or Bad?

A negative PE ratio is neither good nor bad. It is just a metric to show the earnings of the company.

Can A PE Ratio Be Negative?

Yes, the PE ratio can be negative or positive. But a negative PE ratio does not mean losses all the time.

Should I Buy A Stock If Its PE Ratio is Negative?

The decision to buy a stock should not solely depend on the PE ratio. Even if the PE ratio is negative, the company has the potential to rise in the future and can prove to be a good investment for you.

Is P/E Ratio High Or Low Better?

Generally, a High PE ratio is considered better. But from the investor’s perspective, it does not matter whether the ratio is higher or lower.

Is a Negative Price-Earning Ratio A Bad Sign For Investors?

A P/E ratio that is steady or exhibits a steady increase is a good one with a good earnings yield. But, of course, the earnings yield could differ depending on the specific company, which means that it is not always bad for investors.

What Are The Other Names of Negative P/E Ratio?

P/E Ratio is also known as ‘earnings multiple’ or ‘price multiple’.

What Are The Reasons For The Stock Decline?

If it’s in decline, it is a temporary event due to the business cycle.

Can A company’s Total Shares Outstanding Be Negative?

The overall market shares outstanding can never be negative, as it is the number of shares held by all of the company’s shareholders, including equity share blocks held by investors and constricted shares owned by the company’s officers and insiders.

What Is P/E Ratio?

The PE ratio is widely used for stock selection. In simple words, the P/E ratio shows us how much an investor in common stock pays per dollar of earnings in the share market.

What Are High and Low P/E Ratios?

A high P/E indicates a stock’s price is high compared to earnings, while a low P/E shows a stock’s price is low compared to earnings.

What Is PEG Ratio?

The PEG ratio refers to the Price-to-Earnings-to-Growth ratio. Many investors prefer this method for stock selection of different companies.