Introduction

Sensibull is India’s largest options trading platform, providing options traders with many features and benefits. This comprehensive review covers the features, tools, and assets offered by Sensibull and the pros and cons of trading with the broker. Read ahead to learn interesting insights on options trading in India.

What is Sensibull?

Sensibull is an easy options trading platform founded in 2017 and regulated under SEBI, allowing traders to practice options trading legitimately in India. Sensibull offers low-risk strategies, a live options chart and an array of market analysis tools to predict price and market movements.

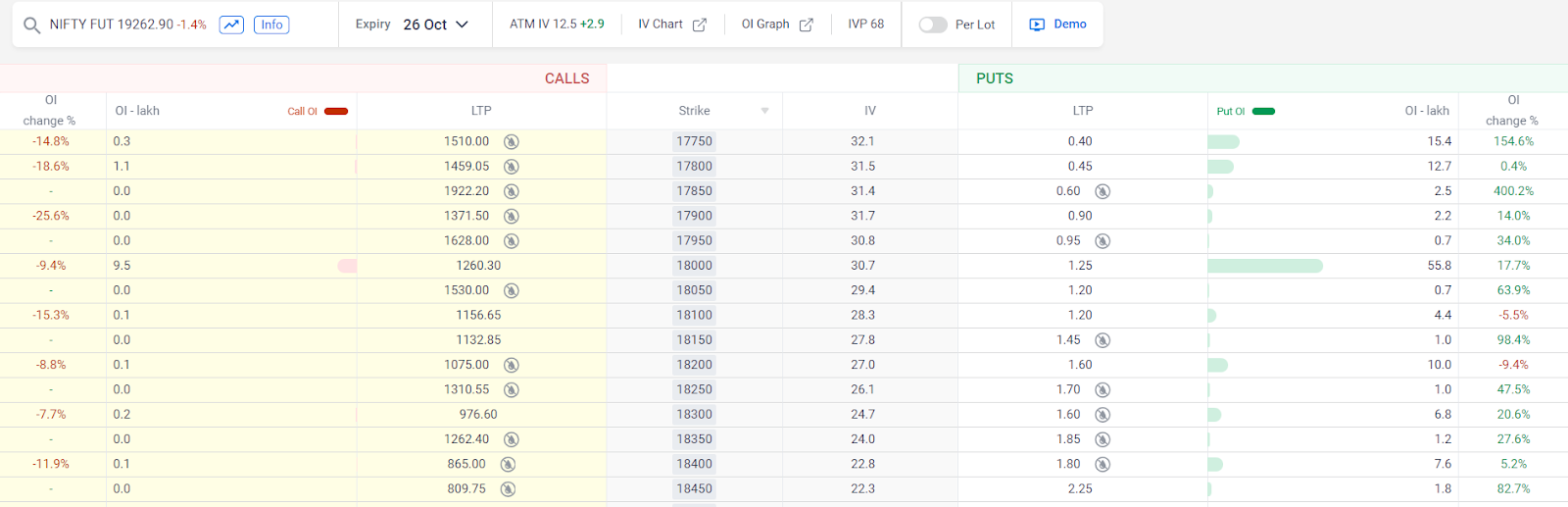

What is the Sensibull Option Chain?

The option chain is a compilation list of Call and Put options along with details of each option, including unlying assets, strike prices and expiration date, making it easier for traders to analyse the options and make decisions.

The underlying assets will either be stock or security, and you can review the price hike and drop before selecting your option from the options chain list. Sensibull has a user-friendly options chain list, which you can easily navigate from the broker website. The option chain in sensibull is listed on the website, as you can see in the image below:

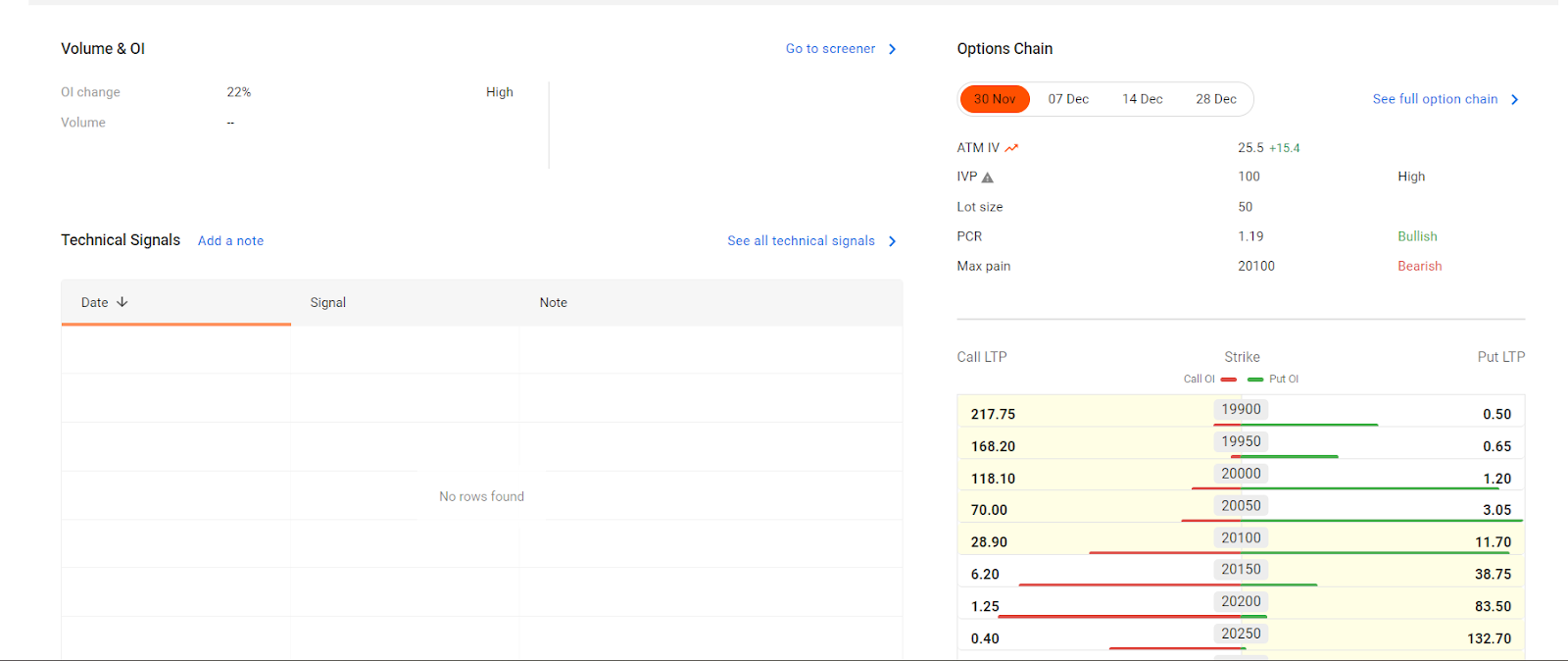

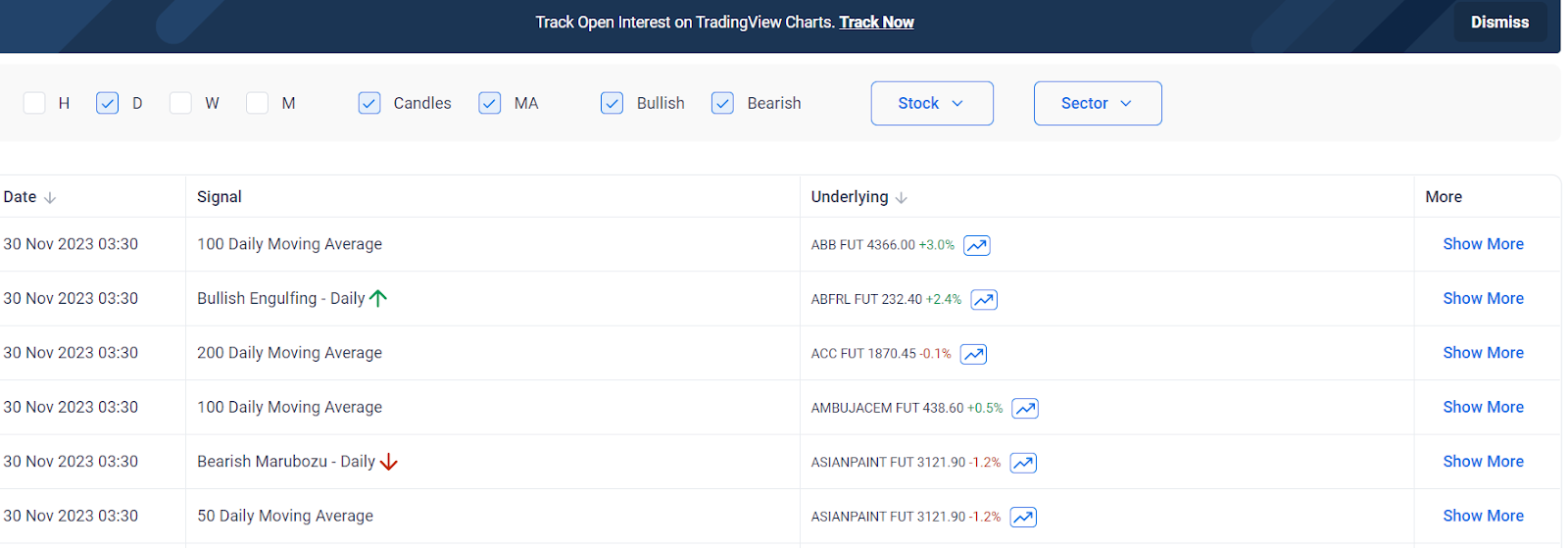

Market Analysis Tools Offered by Sensibull

Sensibull offers several analysis tools like stock data, screeners, technical signals, IV charts, stock market calendars, etc. These tools are easy to navigate and provide the exact position of the Market and asset prices. Stock data helps track the changing value of open interest, as seen in the image below:

Regarding the track open interest trading feature, it helps you keep track of price fluctuations of the underlying assets of options, which can ultimately help you choose the correct option with maximum gains. If you wish to learn more about options trading market analysis tools, check out tutorials provided by Vault Markets.

What is Sensibull Strategy Builder?

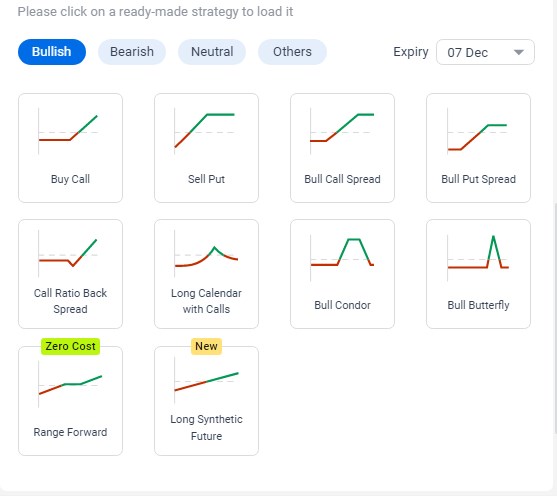

One of the key features of Sensibull is the strategy builder, which allows traders to not only use ready-made strategies but also build customized strategies to cater to different needs. Through the Sensibull strategy builder, you can analyze your market position and understand how an open position would react to market fluctuations.

The platform provides ready-made strategies, including Bullish and Bearish strategies, as seen in the image above. A bullish strategy is used when the trader is confident about a price hike but conflicted with the decision to buy the option.

In this case, the Bullish strategy comes in handy where the trader simultaneously buys and sells options with the same expiration date. For the best trading platform for Bullish stock trading, opt for YunikonFX broker. The Bearish strategy, on the contrary, is used when the price fall of an option is anticipated, and the trader Puts long to remove potential risks.

What is Sensibull Backtesting?

Backtesting is analyzing a trading strategy with the help of previously used data, which means through this broker, you can use previous sensibull option chain data and predict the viability of a trading strategy. This can be considered a good risk management strategy by practising a trading strategy and predicting its’ effectiveness over time.

Assets offered by Sensibull

Sensibull offers trading with three primary assets, including NIFTY, BankNIFTY and FINNIFTY. Let’s look at each one in detail:

- NIFTY: It stands for National Stock Exchange Fifty and includes 50 large-cap stocks from various sectors. Sensibull NIFTY option chain includes a wide range of authentic stock and security assets, making the broker an efficient place for options trading. Unfortunately, it does not offer a USDINR option chain, but you can check Botbro broker for that.

- BankNIFTY: Bank Nifty is an index under the Nifty family which focuses on the banking sector and includes highly liquid banking stocks for trading. Sensibull offers a wide range of Banknifty assets with a strike range of 30,500 – 58,000.

- FinNifty: FinNifty stands for financial Nifty, which includes stocks from the financial sector and provides traders with a wide range of options. Sensibull is a hub for options trading with a large amount of underlying and high-valuing assets.

Does Sensibull Provide Paper Trading?

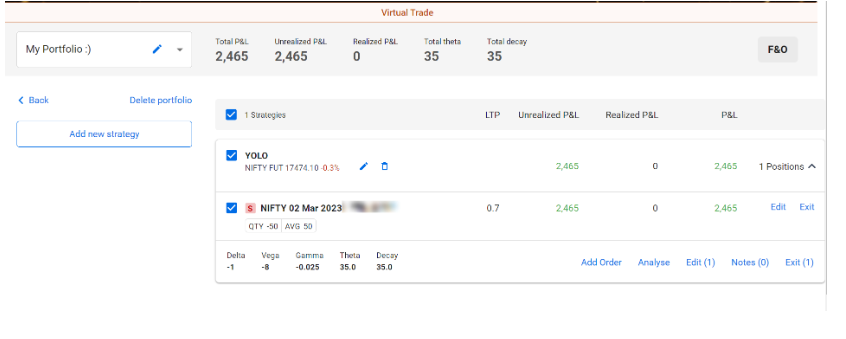

Yes, Sensibull provides the option for paper trading through a virtual portfolio, which allows you to trade without the risk of losing money. Sensibull virtual trading is a great tool for practising options trading without buying or selling the options.

Since it does not require any deposit, it is most suitable for novice options traders, and it complies with SEBI and NSE regulations, making it a safe space for traders. To start Sensibull paper trading, log in to your account via credentials or Google account and proceed.

Platforms Offered

Sensibull offers a wide range of trading platforms, such as Free, Light, and Pro accounts, to cater to the needs of different traders. Let’s look at the platform sensibull offers in detail:

Free Account

It is best for novice traders as it requires no initial deposit and provides the basic features for options trading. However, it lacks certain advanced features like real-time market updates, paper trading, etc.

Lite Account

The minimum deposit required to trade with a Lite account is 800 rupees monthly. Still, it comes with exclusive features like Comparing options, Advance Event Calendar, Basket Orders, Strategy Generator, etc.

Pro Account

It’s the last and most expensive account type offered by sensibull, starting with a monthly deposit of 1,300 rupees. This platform includes all the features of the Lite account plus additional features like Lot Tracking (Up to 30), Customized strategies and more Currency Options. Although this package has numerous features, it can seem pricey, especially for novice traders; opt for TradeEU for a cheaper option.

| Free Account | Lite Account | Pro Account | |

| Minimum Deposit | The free account requires no deposit | Subscription of 800 INR per month | Pro account requires a 1,300 INR monthly deposit |

| Features | The Free account offers an option chain and event calendar. |

|

|

| Upcoming Features | None |

|

|

Sensibull Login Details

To log into your Sensubull account, follow the steps below:

- Visit the Sensibull website.

- Locate and click on the login button, or you can sign up with your Google account.

- Enter the Sensibull login credentials and proceed.

- Now, you will be directed to your options trading dashboard.

Options Trading with Sensibull

Below is the step-by-step process of starting an active Sensibull trading account.

Step 1: Visit Website

To start options trading, visit the broker platform, enter your credentials and log into your account. You will find your personal trading dashboard once the sensibull login process is complete.

Step 2: Select Strategy

The next step after creating your account is customising your trading strategy, and you have to select between Sensibull Nifty, Banknifty and Finnifty. Followed by the asset type, market view, target and target date.

Step 3: Choose Option Type

Once you set the target range, many options will fall under that range, and you have to select a particular option per your preference. Sensibull lets you choose your options through three categories: option quality (premium), expiration date and strategies.

Step 4: Call or Put

Now that you have narrowed down your choices and selected the option you wish to trade with, you must decide whether to call/buy or put/sell your option.

Sensibull Zerodha Trading

Zerodha is a different online stock trading platform in India, and Sensibull offers free options trading to Zerodha users. With this offer, Zerodha Sensibull users can enjoy additional perks and trade options with advanced features without paying any charges.

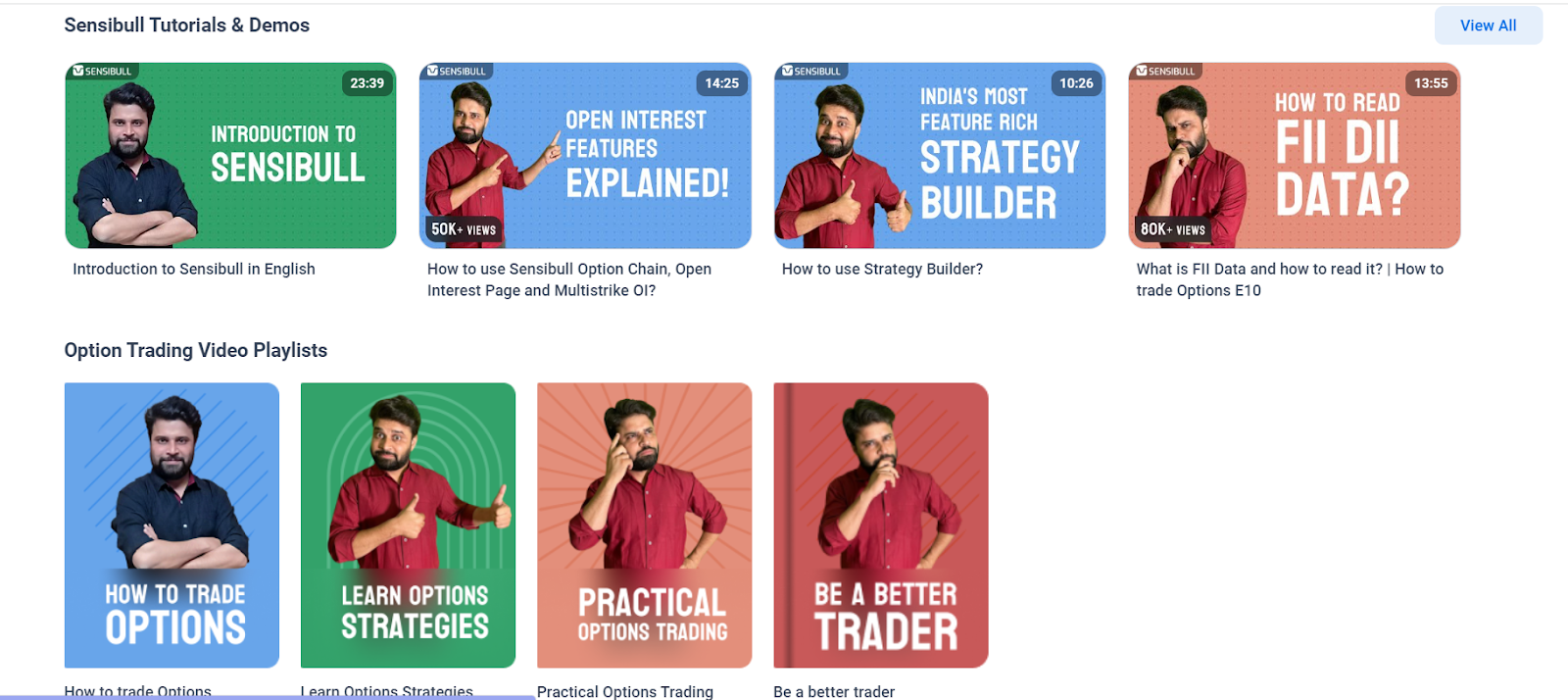

Educational Resources

You can find many educational resources and video tutorials on the Sensibull official website and learn about options trading in detail.

Moreover, the platform also offers active alerts on Market and price movements through WhatsApp to keep traders updated on fluctuations.

Sensibull Customer Support

The platform offers limited but effective customer support services through email support and 24/7 live chat. For any queries, reach out to the customer care agents through:

- Email: [email protected]

- Live Chat: On the website.

We went through the Sensibull website to check the broker’s customer support services. We have found that the response on live chat is delayed, but the answers are precise and resolve queries.

Opstra Vs. Sensibull

Opstra is another Indian options trading platform and Sensibull’s biggest competitor; let’s break down the features and differences of each broker platform to see which one is better.

| Opstra | Sensibull |

| Opstra does not allow traders to place orders directly on the platform. | Sensibull, on the other hand, allows direct order placement, saving traders the hassle. |

| Opstra is a better platform for backtesting by providing a robust set of tools. | Sensibull does provide backtesting, but it has limited features. |

| Opstra’s user interface is restricting and complex compared to Sensibull | Sensibull has a user-friendly interface |

| The tool usage fee is high and may be unsuitable for novice traders | The charges are relatively higher for Lite and Pro accounts; you can opt for Capitalix broker to access a relatively lower minimum deposit. |

| Opstra only focuses on volatility skew analysis and options algorithm | Sensibull offers a wide range of market analysis tools like tracking open interest, etc. |

| Opstra does not have an external integrated broker. | Sensibull has ties with multiple brokers like Zerodha to allow seamless trading. |

Overall, Sensibull has more features that are suitable for novice and experienced brokers alike. Therefore, Sensibull is the better choice for options trading.

Conclusion

Sensibull is a great platform for options trading as it provides a great set of trading asset options and features like Strategy Builder, track open interest, etc. The platform also provides educational resources through video tutorials and robust customer support through live chat and email support. Moreover, Sensible offers option chain assets, including stocks and securities under Nifty, Bank Nifty, etc. Overall, this platform is indeed the top options trading choice as it is regulated by SEBI, which provides safety and security to traders.

FAQs

What is Sensibull?

Sensible is an online options trading platform with many underlying assets, including stocks and securities under Nifty, BankNifty and Finnifty. Sensibull, headquartered in Bangalore, Karnataka, is considered to be India’s largest options trading platform.

Who is the Founder of Sensibull?

The Sensibull platform was founded by three co-founders: Abid Hassan, Balajee Ramachandran, and Sidharth Reddy.

What is Sensibull’s Original Name?

Sensibull was originally known as Riskilla Technologies Pvt. Ltd.

Is There a Sensibull App?

Yes, there is a Sensibull app available for Android and Apple devices. You can download the app through the Google Play Store or the Apple Store.

Opstra vs Sensibull: Which is Better?

Sensibull is the better platform for options trading because of its easy user interface, robust set of Market and price prediction tools, and free educational resources.

How to Use Sensibull in Zerodha?

Users must have a demat account on the Zerodha platform to take advantage of free options trading. You can simply go to the Zerodha Kite platform, log in or sign up, and find a tab for Sensibull trading where you can start trading for free.

How to Backtest in Sensibull ?

Backtest refers to analyzing a trading strategy using historical data. Sensibull claims to provide backtesting, but the website lacks much detail.

What is Max Pain in Sensibull?

Max pain is the trading theory that says that when buyers experience maximum loss, and sellers experience minimum loss, the stock has a high chance of expiring. Sensibull traders can apply this theory to be wary of potential losses.

What is Virtual Trade in Sensibull?

Virtual trade in Sensibull can be done through virtual portfolios where traders do not have to invest money for trading. You can start practising trading by using the platform’s virtual currency or paper currency.

What is Options Trading?

Options are contracts associated with underlying assets that traders can buy or sell at a specific price and time. Options trading is entirely based on Market and price predictability, but once you buy an option, you are allowed but not obligated to trade the underlying assets. Suppose you call or buy an option, but the price does not move in the anticipated direction; then you will lose your investment and incur a loss.

There are no reviews yet. Be the first one to write one.

There are no reviews yet. Be the first one to write one.

There are no reviews yet. Be the first one to write one.

There are no reviews yet. Be the first one to write one.