Options trading Vanguard is one of the best ways to trade options with the right trading platform. Options are a fantastic way to increase your portfolio’s leverage, reduce risk, or earn money.

Options trading techniques can be basic or sophisticated, such as buying a call option when anticipating a significant price gain up until the option expiration date or using multi-leg options.

Various risk and complexity levels are present in options trading methods. Only on a margin account can some risky trades be executed, such as writing uncovered put options or selling call options on securities you don’t own.

However, less risky tactics are also permitted on cash accounts, such as purchasing a call option. Here we’ll examine whether some Vanguard rivals provide a superior substitute by charging less or having access to more markets.

What is Vanguard?

Vanguard is a leading broker mainly known for options trading in the most favourable conditions. The broker offers many unique features like the Vanguard Portfolio watch and a good quality trading platform, and others. All these features are quite helpful in options trading with Vanguard.

Before we delve deeper into the process of options trading with Vanguard, let’s talk about options trading a little.

Another Best Options Trading Broker InvestBy

What is Options Trading?

One of the simplest forms of trading currently available is options trading, which is a method of trading based on predicting the price of a stock, index, commodity, or forex pair.

An option is a contract that enables a trader to purchase or dispose of an underlying asset at a predetermined price and over a predetermined time frame. On the options market, which trades contracts based on securities, options are bought and sold.

You can trade call options and put options, which are the two forms of options available.

How to trade Options with Vanguard?

You can trade options with Vanguard in different scenarios. First, you should be aware of your trading goal. Let’s understand how you can exercise call options and put options with Vanguard.

Call Options

In a call option, the investor is granted the right to purchase a predetermined number of shares of a particular security or commodity at a predetermined price over a predetermined period of time.

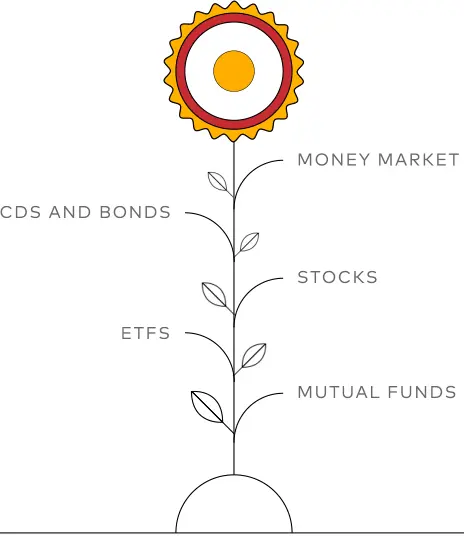

A call option, for instance, would enable a trader to purchase a specific number of shares of stocks, bonds, or even other financial products like ETFs or indexes in the future.

Purchasing a call option indicates that you want the stock or security’s price to increase in order to profit from your contract by exercising your right to purchase those stocks and typically sell them soon away in order to realise the profit.

Through Vanguard, you can place all your trades in the right direction in order to make a profit in call options.

The premium is the cost you incur when purchasing a call option. In essence, it represents the cost of purchasing the contract that would eventually let you purchase the stock or security.

Put Options

The right to sell a specific number of shares of a particular investment or commodity at a specific price over a specific period of time is granted by a put option, on the other hand. A put option gives the trader a choice but not the responsibility to sell securities by the contract’s expiration date, just like call options do.

Through Vanguard, you can agree on the right strike price and place your trade to write your option and make profit. The strike price in the put option is the value at which you agree to sell the stock, much like with call options, and the premium is the cost of the put option.

Put options function similarly to calls, with the exception that if you are purchasing a put option to earn a profit or selling a put option if you believe the price will rise. In contrast, to call options, put options have a greater inherent value the higher the strike price.

Trading platform

There are numerous platforms available for trading options. Not all platforms are made equal; several are eager to invite users to sign up and begin trading without assisting them in understanding what they are doing. You must select a platform like options trading Vanguard that is built for your success if you want to be the most successful trader possible.

Vanguard only provides a fundamental order interface because it is not a broker for active traders. The absence of a trading platform is not at all adverse to the proper kind of investor, but it does not benefit the company in the eyes of active investors. Vanguard will still be useful if you just plan to trade occasionally or purchase funds.

To have a good experience of a trading platform, you must go for MetaTrader 4 (MT4) trading platform. You can find this platform on a leading brokerage firm Investby.

Is Vanguard Safe And Secure?

Yes, Vanguard is a part of the SIPC, which provides protection for high-value assets in the extremely improbable case of bankruptcy. Through Syndicates at Lloyd’sLloyd’s of London, Vanguard has also acquired supplementary insurance that offers millions of dollars in cash and securities coverage for each client.

Additionally, Vanguard appears to take data security and privacy very seriously. It provides two-factor authentication, voice verification, account activity notifications, and SSL encryption to secure its website.

Vanguard Portfolio Watch

Vanguard Portfolio Watch is a programme that analyses your portfolio automatically to see how it stacks up against standards that both you and Vanguard have established. Making ensuring that your assets are diversified and reducing risks as much as you can are the objectives.

You can include all holdings in addition to your Vanguard assets to receive a complete view of your financial situation and identify any potential areas of undetected risk.

Portfolio Watch will provide you with a summary of the many types of funds you possess based on a variety of characteristics after you have imported your holdings into the application, such as company size or investing philosophy of value and growth.

Then it can suggest the funds you need to buy to balance out your portfolio if there is a place where you need additional exposure, such as if you own too many funds invested in small businesses. It’sIt’s a cool tool for getting a wide overview of your possessions and potential purchases.

Options trading commissions

The commission structure for options at Vanguard has multiple tiers that vary based on how much money you have invested in Vanguard’sVanguard’s mutual funds and exchange-traded funds (ETFs). For stocks and ETFs, the broker abandoned this tiered system, but it has kept some of it in place for options commissions.

It’s important to keep in mind that your fee for trading options is determined by how much money you have invested in the brokerage’s funds, not just how much money you have in the brokerage itself.

Trading fees

Here are the costs associated with trading ten options contracts that Vanguard levies, expressed in USD. It should be noted that certain brokers employ a strategy that waives closing fees for option trades. Since other brokers charge for both the opening and closing operations in these situations, it is necessary to describe the discount as half of what it actually is for them.

Low-cost funds have traditionally been associated with Vanguard, and this association still holds true today. Vanguard offers more than 130 mutual funds in addition to its own ETFs. Be aware that certain brokers charge you if you exercise your options or are assigned shares.

You can be sure you’re getting a reasonable price if you choose one of its mutual funds or ETFs. Vanguard’s funds don’t have any sales loads and have among of the lowest expense ratios in the business, which would otherwise seriously reduce your returns over time.

The broker, Investby, offers even lower fees for options trading. You can trade a wide range of different options with the broker.

Education

The broker’s planning and education tools are the most blatant example of how Vanguard was founded on the goal and optimistic mentality of founder Jack Bogle to assist individual investors in accumulating wealth. The broker provides clients with market information through articles, videos, and podcasts to assist investors in making wise financial decisions with a long-term perspective.

The broker’s website has a tonne of materials for investors of all ages, including calculators, tools, and resources for retirement planning. Investors can create plans for a range of objectives, evaluate funds side-by-side, screen for funds, and predict education and retirement costs so that they can cover them.

Other than Vanguard, you can take advantage of the InvestBy learning center which offers a variety of educational sources like videos, tutorials, blogs, online courses and more.

Bottom Line

Hope you get the idea of how options trading Vanguard works. Vanguard is still expanding; therefore, it would be difficult to claim that its finest days are behind it. Investor money will keep flowing in due to Vanguard’s low-cost promise for the foreseeable future. But advanced investors can receive the equipment they need and the expenditure ratios they need.

When using Vanguard’sVanguard’s affordable funds, cost-conscious investors can make use of several fantastic benefits. However, other low-cost brokerages like Investby offer the same advantages.

FAQs

Is option trading on Vanguard safe?

Yes, options trading Vanguard is quite safe. Vanguard is known for its high security of clients’ funds and privacy. It is authorised by SIPC.

What are Vanguard option trading fees?

Vanguard charges $10 for stock options and index options. The broker is known for charging highly competitive fees and providing better trading conditions for its clients.

Does Vanguard have options trading?

Yes, Vanguard offers options for trading in a wide range of assets. You can invest in various stock options and index options through Vanguard.

What is Vanguard mini options trading?

Mini options are exchange-traded options. They include the fractions of the standard options contract. You can easily exercise them through options trading Vanguard.